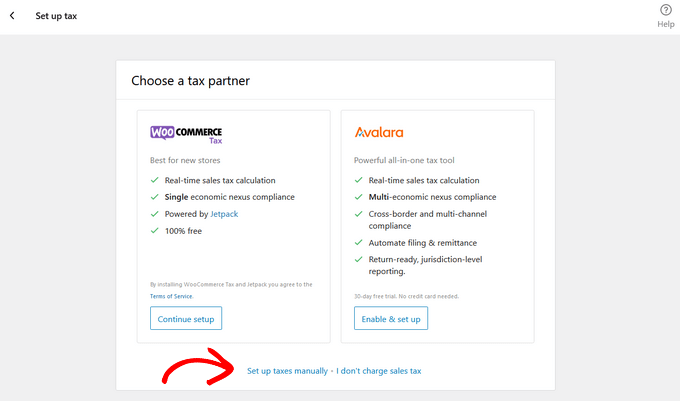

On the WooCommerce home page, the next step in the setup guide is to set up tax.

You can set up taxes with WooCommerce Tax, but we recommend that you set them up manually. You can also select the ‘I don’t charge sales tax’ option if you don’t add taxes.

Add WooCommerce Taxes Manually #

After choosing the manual option, you’ll be redirected to the WooCommerce » Settings » Tax tab. From there, click on the Standard rates option.

If you are doing this outside of the set-up-wizard, use your admin dashboard to go to WooCommerce » Settings » Tax tab. From there, click on the Standard rates option.

There you will find the button to “import CSV”.

Click on the “Import CSV” button.

Select the CSV file that you want to upload.

Click on “import”.

Here’s a little surprise for you too, click here to download our CSV file that is regularly updated with all tax rates for the United States.

How to Update Existing Tax Rates #

WooCommerce now requires you to remove the existing tax rates before you update, otherwise it will duplicate any changed tax rates when you import your CSV file.

From your admin dashboard to go to WooCommerce » Settings » Tax tab. From there, click on the Standard rates option.

- Press and hold the “CTRL” key

- Click to highlight all the rows then release the CTRL key

- Click the “Remove selected row(s)” button

- Click “Save changes” button.

- Upload the new table.

What is Sales Tax? #

Sales tax is a type of consumption tax levied by the government on the sale of products and services by businesses and individuals. In a traditional sales tax system, taxes are collected at the moment of sale and then remitted to the government by the shop. It is a business’ responsibility to pay sales taxes in a given jurisdiction if the company has a nexus there, which can be a physical presence, an employee, an associate, or some other form of presence, depending on the rules in that country.

What is a Tax Nexus? #

In order to determine which agencies, and hence which states, you must pay tax to, the first step is to determine which agencies you must pay tax to. What state you have a connection with is determined by whether the connection is physical – such as the warehouse where you store the items – or non-physical – such as the contact person who assists you in selling the goods.

The relationship between your organization and the state is referred to as a nexus. If your company is subject to state sales tax, Nexus will assess whether or not you are due. If you do not have a physical presence in a state, you are not required to pay taxes in that state. For many small businesses that are just getting started, you may only have a nexus in your home state, which means that you only collect sales tax in your home state.

You will be required to register and pay taxes in each state where your company has a physical presence. Registering in your home state (in which your company is located), declaring that you are attending on business, indicating states where you have fulfillment services, remote employees, and affiliate marketing programs are all examples of what you should do. Your company will receive an official sales tax license as a result of your registration. Businesses selling taxable items in their state are required to register with the state at least 1-2 weeks before the sale takes place.

The information presented on this page does NOT constitute legal advice. We recommend that you discuss the required taxes with a professional.